1.

How does Wealthclock earns?

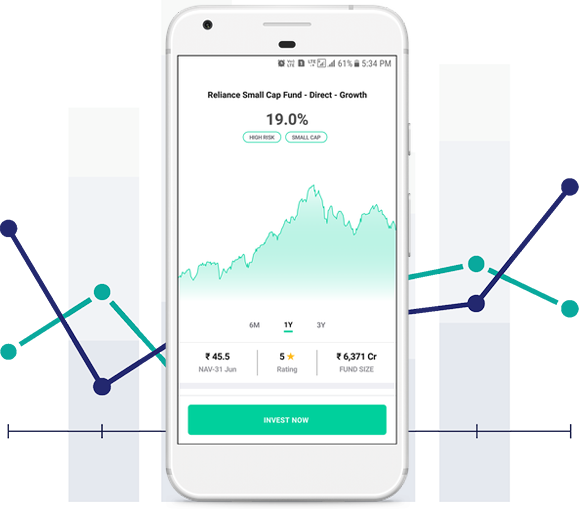

Wealthclock understands your financial needs at various interval of life and creates a Customized Mutual Fund Investment curated just for you.

Wealthclock follows Algorithm to pick best performing funds every 6months. It thus help us to review our portfolio and make necessary changes.

Inflation beating growth

while managing risk

Inflation beating growth

while managing risk

Inflation beating growth

while managing risk

Inflation beating growth

while managing risk

Single login for you and your family to view your portfolio and execute all investment orders from one screen.

Get your portfolio statement in a click go.

Available 24hours to help you with any suggestion or execution on any investment need.

Turbo charge your investment with our expert advice on top-up at right time

Wealthclock is committed to bring a continuous trajectory of profitable performance to your funds and make informed changes whenever it requires.

1.

How does Wealthclock earns?

I am happy to answer that. No fees, no hidden charges. We earn a small fee from mutual fund companies.

2.

When can I start investing?

You need to call us and our Expert will discuss on to understand your financial status and your future needs. Based on that, we create a customised portfolio. It takes couple of hours to then complete your registration and to verify details. You can then start investing.

3.

How do you ensure that my money is secure?

Pls note that we are not holding on to your investment. Your money is invested directly from your bank to a mutual fund account. We only maintain records and provide your mutual fund investment details. You can view always by login and you can download statements as well.

4.

Why should I use wealthclock for investment?

Customized solution, understanding your financial status, creating your financial Goals, and do ask our customers. We have excellent customer service and rapport with all of them with almost 100% retention rate.